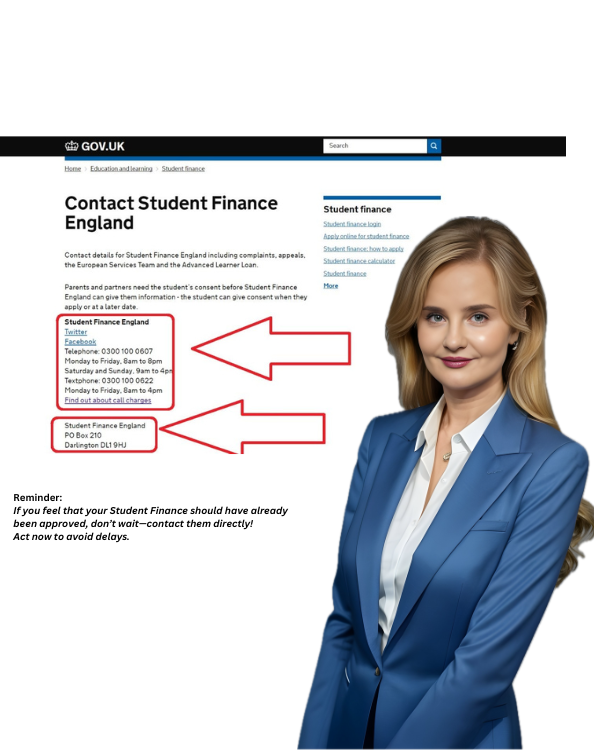

Home Student Finance

Mahatma Gandhi

The loan covers

100% of the Tuition Fee.

If you’re studying an undergraduate course, you could get a Tuition Fee Loan. A Tuition Fee Loan covers the cost of the fees charged by your university or college.

If you’re starting a full-time or part-time taught or research master’s course, you could get a Postgraduate Master’s Loan.

Content provided by Student Finance England.

Repaying your Student Finance loan in England is income-based, meaning you only start repaying once your earnings exceed the set threshold. For Plan 2, the threshold is £27,295, while for Plan 5 (for students starting in 2023/24 or later), the threshold is £25,000 per year. You’ll pay 9% of your income over the threshold, ensuring that repayments remain manageable.

For postgraduate loans, the repayment threshold is £21,000, and the repayment rate is 6% of income over this amount

The loan will be repaid year after graduating ONLY IF you take up employment and your earnings exceed the set annual threshold for the country where you are working, and more specifically, where you settle your taxes. Your parents’ earnings are not taken into account. If you have not reached the threshold, 30 years later the loan is officially redeemed.

When you have no income above the threshold amount in the country where you are working, discontinue working or go on leave, the repayment is suspended – you do not have to pay. So, as you can see, this is not a typical loan. No bank will offer you such a holiday.

If your income exceeds the repayment threshold, you will repay 9% of the earnings above the threshold for undergraduate loans. For postgraduate loans, the repayment rate is 6% of income above the threshold. These repayments are a small percentage of your income, designed to ensure they remain affordable compared to your overall earnings.